Miss Winslow

by Daniel Huertas | Feb 17, 2020 | Uncategorized

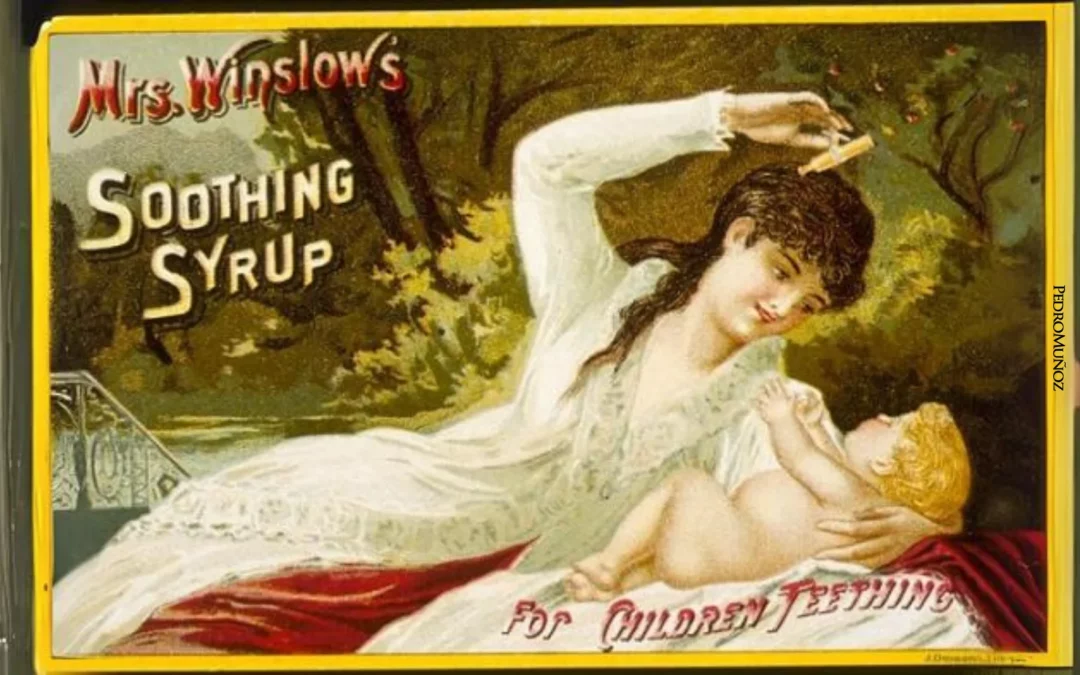

How did mothers manage to reduce their children’s fever more than a century ago? With Miss Winslow’s syrup. This remedy was brought to us by Charlotte Winslow, who marketed it in the mid-19th century. Its calming effect was much faster and more effective than current antipyretics, probably because it contained pure morphine. In 1910, The New York Times published an article exposing these calmatives that contained morphine sulfate, chloroform, and heroin. Indeed, you know what follows. Miss Winslow’s syrup is the pharmaceutical equivalent of Central Bank liquidity injections. The same effective short-term impact, but we’ll soon see if it has any long-term side effects.

Although our capacity for surprise regarding market movements is generally low, what we are seeing these days does provoke at least a slight raise of our left eyebrow. For example, seeing how Apple, despite having its production plants closed in China, has increased its capitalization by $100 billion since the coronavirus started, approaches my likelihood of spending a night reciting Calderón de la Barca beside Olivia Wilde. But all this reinforces our main idea that markets are solely guided by liquidity. Forget analyzing whether Coca Cola can increase its sales figures in West Africa, or if Inditex will improve margins in its children’s clothing section; there is an almost perfect correlation (almost is a literary figure) between the size of central banks’ balance sheets and stock market capitalization. In the last fifteen days, as stock prices rose, long-term interest rates fell. The widespread belief remains that Central Bank protection is unbreakable and in any economic doubt, the response will be to flood the market with money. Money that we already know will go to financial assets more than to investment. At the end of January, the volume in the aggregate balance of all American commercial banks, in the section related to mortgage loans, showed a figure of $317 billion, almost 50% less than the peak in April 2009, and similar figures to those in 2004. Families have mainly been focused on paying off debt rather than taking on new debt as the monetary authorities would like. It can also have a second reading, which is that bank balance sheets have fewer assets considered “safer” and more loans with fewer guarantees such as consumer loans for car purchases, credit card refinancing, or student loans. If we look at a part of these loans (credit cards), we find a curious fact. While this week a new historic low was reached for the set of investment grade bonds in dollars, at 2.62% (with an inflation rate of 2.3%, it is almost free money in real terms), the average rate on credit card loans was 16.9%, rising from levels below 13% that it had between 2011 and 2014. It can be argued that credit cards are the highest risk in a bank’s balance sheet, and that the customer who resorts to it is the least reliable, but the increase in the spread is still striking.

But the bullish narrative remains intact, trade relations are improving nonstop, a scenario ahead in which not even our grandchildren will see an interest rate hike, profits will improve because they didn’t last year, if they fall it will be a temporary issue that will be resolved in the next quarter, if Sanders rises it will be good because the Republicans will win the elections by a large margin, and if Sanders wins the elections, he will boost public spending, which can be even better for companies, the fact is that the prevailing mentality is indomitable in a process permanently fueled by rising stock values. And the main beneficiary is still the United States. If 10 years ago, American stocks represented 30% of global capitalization, now they represent 40%. We can compare it with Spain, which has gone from representing 1.50% of global capitalization then to 0.82% now, almost a 50% drop in its weight.

Of course, it is not the only case of an abrupt decline. If we look at emerging markets, we have more dramatic cases. Mexico reached its historic high in 2013 and since then its indexes for a European investor have fallen by 40%, Brazil did so in 2011 and has fallen by 35%. Similar cases are found in Turkey (highs in 2013 and a 54% drop) or Indonesia (highs in 2013 and a 32% drop). However, countries like India or Russia have their stock markets at all-time highs.

If we analyze by sectors, we can see how the equivalent of “orange is the new black” is “utilities are the new tech.” The valuation they have right now trades at growth company numbers. We already mentioned that anything healthy, clean, or social is creating an investment bubble that does not cease. Massive liquidity encourages investment desires that will increase electricity supply to quite significant levels, and many of them are not taking into account the effect it will have on future prices. We will see the consequences of this bottleneck…

When we observe all these excesses, it is advisable to follow the advice given yesterday by young Charlie Munger (96 years old) at the Daily Journal’s annual shareholders meeting. “I think many problems are coming,” “There are too many miserable excesses,” “In China, they love to play with stocks, it’s really stupid,” “It’s hard to imagine anything dumber than the way the Chinese hold stocks” are some of the phrases he uttered.

He also criticized the prophets who use EBITDA as the new sacred figure instead of the traditional post-tax profit as an argument for many exaggerated valuations. He also mentioned that the boom we are seeing in innovation could begin to wane. Warning to navigators.

You already know that modern clairvoyance is called pessimism.